印尼禁矿细节将正式公布 宏观经济利空冲淡利多

梁伟刚

周四(2012.05.03)印尼矿业部长JeroWacik在雅加达的新闻发布会上表示,将从5月6日起将对包括铜、金和锡在内的14种矿石平均征收20%的出口税。这14种矿石是铜,铅,镍,金,银,锌,铬,铝土矿,锰,钼,铂,锑,铁矿石和铁砂。在这14种未加工的矿产中,红土镍和铝土矿的最大出口国是中国。如此看来,对中国的出口禁令提前了2年。原计划是2014年执行。印尼要求对没有在本地提交深加工矿石计划的公司,将被禁止出口;如果有生产建设计划可以继续出口,但需要缴纳一定的税。由此看,一旦出口禁令正式执行,将导致印尼在2012年镍矿石与铝土矿出口锐减75%。2011年印尼出口了3300万吨红土镍和4000万吨铝土矿(原文附后)。

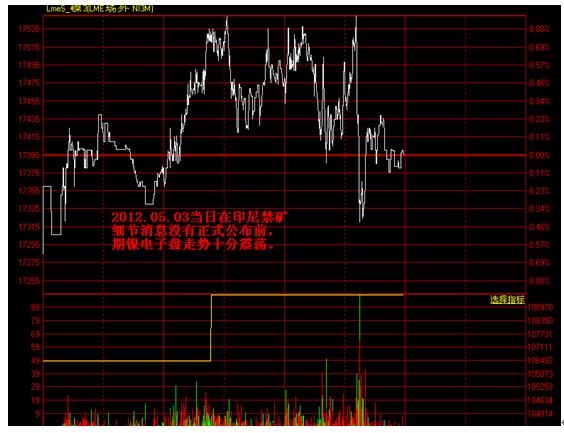

对此,LME期镍盘中立即得到了反应(参见图1),一改先前的单边跌势。但是,由于前期市场已经在反复受到该消息的影响,突发作用已经没有;况且外围的宏观经济态势暂时还不够配合,经济前景依然偏向下行风险,大大减弱了这种利好因素。

先前公布的全球各地区的制造业数据并不理想,近期的美国经济数据也不及预期,眼下美国非农就业数据还未公布,欧元区经济前景仍有风险,主权债务危机问题仍威胁经济成长。如此多的利空因素冲淡了印尼禁矿征税的利好因素。

市场参与者仍然在忧虑全球经济的不景气会影响基本金属的需求,盘中交易十分谨慎,已经处在阶段低位的期镍盘中走势十分震荡,在缺乏新多资金介入前,期镍本身的技术形态也不支持即刻的涨势。暂时看,多头力量的集聚程度仍不够发动一波低位的反弹,因此才会有图1形成的震荡走势。可见市场仍在消化印尼禁矿征税的利好可能对期镍形成的影响,因为市场参与者在权衡即便禁止出口红土镍矿石,在全球经济表现不佳的大环境下,究竟会对镍价产生多大的影响,目前新矿项目纷纷投产及不锈钢产业放缓将压制镍价上行高度。

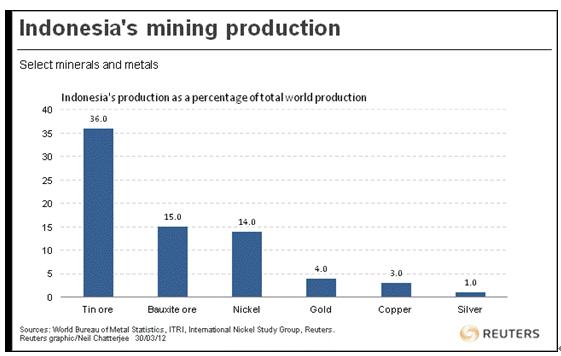

图2为印尼主要矿产占世界产量的百分比

从图2左起,由高至低依次是:锡矿占比36%(全球第二大资源国);铝土矿15%;红土镍矿14%;金矿4%;铜矿3%;银矿1%。此外,印尼还有丰富的煤炭资源,总储量约为1050亿吨。可见,矿产业是印尼的支柱产业之一。有数据显示,矿产业占印尼国内GDP生产总值的12%;并且在出口创汇中也占有重要地位。实际上,2011年,印尼的精炼镍产能才占全球精炼镍产能的比重只有1%。印尼此举最终仍会对矿产业产生深远的影响。至少对中国镍生铁行业的红土矿供给产生极大的影响。因为,2011年中国从印尼进口镍矿石占总进口量的52%。很显然,后续的影响将会逐步显现。

By Yoga Rusmana, Fitri Wulandari and Femi Adi - May 3, 2012 8:01 PM GMT+0800

The regulation applies to copper, lead, nickel, gold, silver, zinc, chromium, bauxite, manganese, molybdenum, platinum, antimony, iron ore and sand iron, Energy and Mineral Resources Minister Jero Wacik said at a press briefing in

The largest nickel-ore and bauxite supplier to

“Miners will still be allowed to export after meeting some requirements, including obtaining permits, Edi Prasodjo, a director of coal at the Energy and Mineral Resources Ministry, said at a conference in Jakarta earlier today. “The IUP must be clean and clear, paying taxes and royalties,” Prasodjo said, referring to a mining business license by its Indonesian initials.

‘Killing Us Slowly’

“We were shocked when the government announced in February that nickel ore would be banned, I. D. Susantyo, a member of the board of directors at the Indonesian Nickel Association, said in an interview. “Now they said we can still export but we have to pay tax and meet other complicated requirements. It’s still killing us slowly because it will cut our margin because our buyers will pay the same price based on the international benchmark.”

The government hasn’t decided whether to tax some coal shipments, Coordinating Minister for the Economy Hatta Rajasa said at the briefing.

“There are things that need to be studied,” he said. “For example, will it be necessary to apply an export tax to producers that pay lower royalties.”

The government will order miners exempted from the ban to sign a letter of commitment that they will stop all ore shipments by 2014, Thamrin Sihite, director general of minerals and coal at the energy ministry, said last month. The exporters must also obtain an export permit from the Trade Ministry, said Deddy Saleh, director general of foreign trade at the ministry.

Reduced Shipments

The Indonesia Mining Association estimated in March that the ban will cut nickel-ore and bauxite exports by as much as 75 percent this year.

The curbs, aimed at lifting the value of shipments and boosting local smelting capacity, apply to exports of raw metals including iron ore, gold, and silver, and bring them in line with the rules that have applied to tin since 2002, with only refined exports permitted.

[需要查看更多数据,请免费试用钢联数据]